The decision to develop a DEX follows a severe security incident earlier in July 2024, when WazirX fell victim to a cyberattack that led to a staggering $235 million loss. The breach, reportedly orchestrated by the infamous North Korean Lazarus Group, underscored the risks of centralized exchanges and prompted WazirX to explore alternative solutions to ensure user safety.

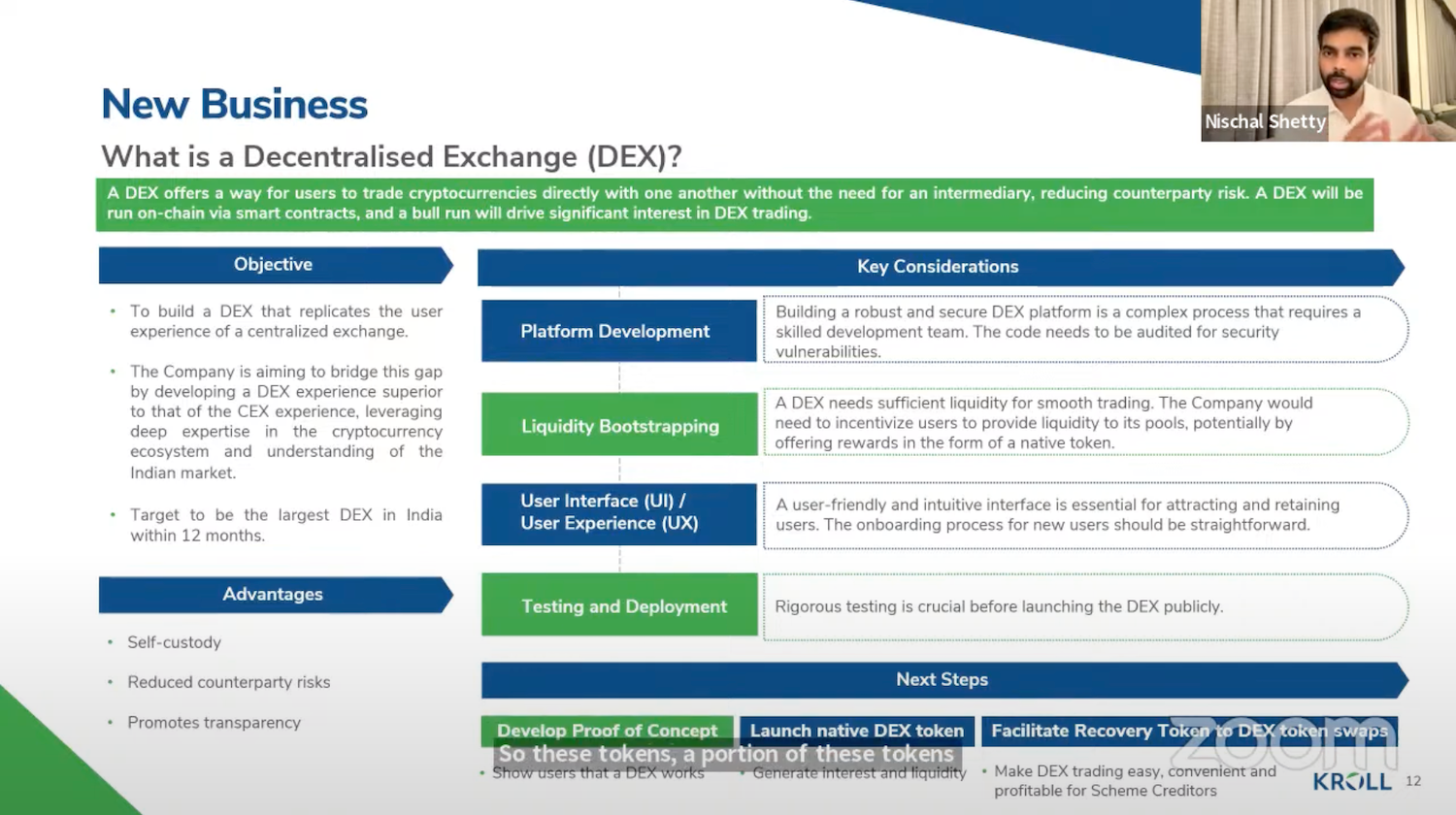

Centralized exchanges, while popular for their user-friendly interfaces and robust liquidity, present challenges, particularly in terms of security. Because these exchanges retain custody over users’ assets, they are often lucrative targets for hackers. By transitioning part of its infrastructure to a decentralized model, WazirX aims to give users the freedom to trade directly from their wallets, reducing the likelihood of large-scale asset loss due to breaches.

A.k.a – alpha girl. Vinita is the founder of Alphachaincrypto. An English Lit Majors, Vinita bumped into Web3 in 2020 only to realise that tech was her calling. Later, Mathreja worked for some notable brands like Near Education, Biconomy, CoinDCX and top of the line crypto start ups.