As we transition from Web2 to Web3, understanding where economic value will concentrate is crucial for investors, developers, and entrepreneurs. The Fat Protocol Thesis, proposed by Joel Monegro in 2016, provides a framework to assess how value is distributed within blockchain ecosystems compared to traditional internet models.

Web2: Thin Protocols, Fat Applications

In the Web2 era, value was primarily captured by applications at the consumer-facing layer, while the underlying protocols remained largely unmonetized. Foundational protocols like TCP/IP, HTTP, and SMTP enabled the functionality of the internet but did not directly capture much value. Instead, applications built on top of these protocols (like Google, Facebook, and Amazon) became the main value drivers by centralizing and monetizing user data.

In this model:

- Protocols were “thin”: They were crucial for communication but were mostly free and open, meaning they captured little economic value.

- Applications were “fat”: Entrepreneurs and corporations that leveraged these protocols to build closed, centralized networks captured the lion’s share of the value. This is why we see companies like Google and Facebook becoming dominant players in the Web2 space, with massive valuations.

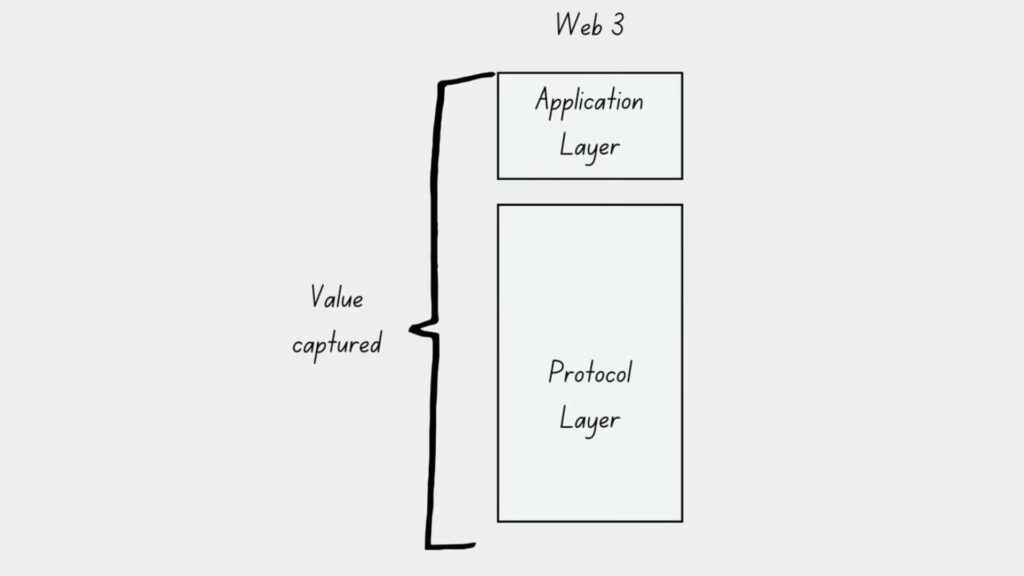

Web3: Fat Protocols, Thin Applications

The Fat Protocol Thesis argues that this dynamic is reversed in the world of blockchain technology. Here, the protocol layer (the base blockchain like Ethereum or Bitcoin) captures most of the economic value, while the applications built on top (such as decentralized exchanges, NFTs, and DeFi platforms) capture relatively less. In this system:

- Protocols are “fat”: Public blockchains like Bitcoin, Ethereum, Solana, and Avalanche capture significant value through their native tokens (e.g., Bitcoin, Ether), which appreciate as demand for the network grows.

- Applications are “thin”: Applications built on these blockchains capture less value relative to the protocol because they rely on the shared, open data layer of the blockchain and cannot monopolize user data.

Why This Happens

1. Shared Data Layer:

In a blockchain ecosystem, data is stored in a decentralized, open, and immutable way. This means no single application can monopolize user data, unlike in Web2 where companies like Facebook or Google control vast troves of personal data. Since the underlying data is open, any application can access it, reducing the barriers to entry for new competitors. This openness creates a more vibrant and competitive ecosystem at the application layer but concentrates value at the protocol level.

2. Tokens as Incentives:

The blockchain ecosystem is powered by native tokens, which are required to access and utilize the network’s services. For instance, Bitcoin is used for transactions on the Bitcoin network, and Ether is used to execute smart contracts on Ethereum. These tokens often appreciate in value due to factors like speculation, scarcity, and demand. As the protocol grows in usage and importance, the token’s value increases, which in turn attracts developers, investors, and users to the network. This positive feedback loop keeps value concentrated at the protocol layer.

Examples of the Fat Protocol Thesis

1. Bitcoin:

Bitcoin, the world’s first decentralized blockchain, illustrates the Fat Protocol Thesis clearly. The Bitcoin network has a market cap of around $1.25 trillion, driven by the demand for its native token, BTC. However, businesses and applications built on top of Bitcoin have much lower valuations in comparison. The protocol layer, powered by BTC, captures most of the value, while the application layer remains “thin.”

2. Ethereum:

Ethereum, another leading blockchain, provides a similar example. The Ether token (ETH), which powers smart contracts and decentralized applications (dApps), has appreciated significantly in value. Even though few breakout applications have yet to emerge, Ethereum’s market cap remains substantial because of the demand for ETH. Developers are drawn to the protocol for its ability to facilitate decentralized finance (DeFi), NFTs, and other innovations, but the protocol itself captures more value than the individual applications.

Layer 2 Solutions and Value Accrual

As Ethereum gains popularity, it faces challenges with scalability. To address this, Layer 2 solutions (e.g., Polygon, Arbitrum, Optimism) work on top of Ethereum, batching transactions off-chain before settling them back on Ethereum’s main chain (Layer 1). These solutions improve Ethereum’s transaction throughput and reduce costs, while still relying on Ethereum’s security and decentralization.

Though some investors speculate on these Layer 2 tokens, the overall value still accrues to Ethereum as the base protocol. Much like Visa and Mastercard facilitate transactions on top of traditional banking systems, Layer 2 solutions enhance Ethereum’s functionality, benefiting the network’s native asset, ETH.

Interoperability & Bridges: A New Frontier?

In the Web3 ecosystem, bridges between Layer 1 blockchains (e.g., the Wormhole Bridge between Ethereum and Solana) enable the transfer of assets across different networks. However, these bridges introduce additional risks, such as vulnerabilities to hacking, as seen in the $325 million Wormhole hack. While bridges could eventually enable seamless interaction across multiple blockchains, security remains a major concern, as pointed out by Vitalik Buterin, the founder of Ethereum.

Despite these risks, interoperability could play a crucial role in Web3’s future, as multiple Layer 1 blockchains continue to grow and become interconnected. Some projects, such as Accumulate, are already developing solutions to connect various Layer 1 blockchains and facilitate the growth of decentralized ecosystems.

Conclusion: Where Will Value Accrue in Web3?

The Fat Protocol Thesis provides a useful framework to understand value distribution in Web3. Unlike Web2, where value was concentrated in consumer-facing applications, Web3 sees value accrue at the protocol layer. Layer 1 blockchains, powered by their native tokens, capture significant economic value as they provide the foundation for decentralized applications and services.

While applications built on top of these protocols will undoubtedly create value and innovation, the shared data layer and open, decentralized nature of blockchains prevent any single application from dominating the ecosystem in the way that Web2 giants like Google or Facebook did.

As the Web3 landscape evolves, it will be essential to keep an eye on how Layer 2 solutions, bridges, and emerging technologies like interoperability will shape the value distribution across the tech stack. Though some value may move up to the application layer over time, the protocol layer will remain the central point where economic value is concentrated.

Shikha is a DeFi Researcher & Analyst with a background in Engineering, history , political science & International Relations.

Gets her inspiration from a combination of strong tea, beaches and cats. She is passionate about the potential of DeFi and crypto adoption across emerging economies.