A stablecoin system was designed to maintain a dollar peg without holding a single dollar in reserve. It relied on a delicate balance of algorithms, market trust, and a sister token for stability. This was the vision of TerraUSD (UST) and LUNA—a bold experiment in decentralized finance. But after a spectacular collapse that sent shockwaves across the crypto world, Terra’s community is now turning to an ambitious burn strategy to restore value and trust. Can the Terra ecosystem find stability again, or is this burn program too little, too late?

Background: The Original Relationship Between UST & LUNA

The Terra ecosystem was built around a unique idea: creating stablecoins like TerraUSD (UST) that could maintain a stable value, or peg, to the U.S. dollar without relying on traditional bank reserves. Instead, UST was linked to LUNA, a cryptocurrency that provided the stability for UST through a mechanism called mint-and-burn.

In this system:

- Minting UST: To create (or “mint”) UST, users would “burn” (destroy) an equivalent dollar value of LUNA. This reduced the supply of LUNA, which in theory helped support its price.

- Burning UST: Conversely, if UST fell below $1, users could burn UST to mint LUNA, reducing UST’s supply and pushing its price back toward $1.

The entire system relied on a balance between UST and LUNA, with arbitrage traders playing a key role. When UST’s price deviated from $1, traders could profit by buying or selling LUNA and UST, helping maintain the peg.

Timeline of Events:

- 2018: Terraform Labs, founded by Do Kwon and Daniel Shin, launches the Terra blockchain and the LUNA token.

- September 2020: Terra launches its algorithmic stablecoin, TerraUSD (UST), pegged to the U.S. dollar.

- 2021: Terra’s ecosystem grows rapidly, with UST seeing high adoption within DeFi.

- September 2021: Terra launches the Columbus-5 upgrade, improving blockchain interoperability and boosting UST and LUNA’s utility.

- May 7-8, 2022: UST begins to lose its $1 peg, leading Terraform Labs and the Luna Foundation Guard to attempt intervention.

- May 9-11, 2022: UST’s peg collapse triggers a “death spiral,” causing hyperinflation of LUNA and severe loss in value for both tokens.

- May 12, 2022: UST and LUNA prices plunge, marking one of the largest collapses in crypto history.

- May 13, 2022: Do Kwon proposes a recovery plan to fork the Terra blockchain, creating Terra 2.0 and Terra Classic.

- May 18, 2022: Governance vote begins with over 80% support for the chain split.

- May 25, 2022: The vote concludes, approving the split of the Terra blockchain.

- May 28, 2022: Terra 2.0 launches with a new LUNA token, while the original chain is rebranded as Terra Classic, with LUNA renamed to Luna Classic (LUNC) and UST renamed to TerraClassicUSD (USTC).

- Mid-2022: The Terra Classic community initiates burn programs to reduce the supply of LUNC.

- August 2022: Transaction tax burns are introduced on Terra Classic to further reduce LUNC’s supply.

- September 26, 2022: Binance announces support for LUNC burns, allocating trading fees from LUNC to burn LUNC tokens.

- Early 2023: The Terra Classic community increases the burn rate and organizes additional community-driven burn events.

- September 2023: Terraform Labs burns 251 billion LUNC and 264 million USTC from Shuttle Bridge wallets.

- October 2023: Terra Classic introduces a “Reverse Charge” tax mechanism, with a portion of the tax revenue directed toward burning tokens.

- November 2023 – Present: Community-led and Binance-supported burn initiatives continue in an effort to reduce LUNC and USTC supply.

Transition and Rebranding

After the dramatic collapse of Terra’s stablecoin, TerraUSD (UST), and its sister token, LUNA, the Terra ecosystem faced an existential crisis. To try to salvage the ecosystem, Terraform Labs and the Terra community decided on a strategic fork of the blockchain.

This decision marked a clear transition:

Creation of Terra Classic: The original Terra blockchain was renamed Terra Classic. On this chain:

- LUNA was rebranded as Luna Classic (LUNC).

- UST was renamed TerraClassicUSD (USTC).

With Terra 2.0, the new LUNA token was no longer tied to any algorithmic stablecoin like UST. Terra Classic retained the failed algorithmic stablecoin model, but with new burn strategies to gradually reduce the inflated supply of LUNC and USTC and help restore some value over time.

To sum up, LUNA became Luna Classic (LUNC), and UST became TerraClassicUSD (USTC) on the old chain, now called Terra Classic.

Burn Strategy Mechanism

- Transaction Tax Burns: A portion of every transaction fee on the Terra Classic network is allocated to a burn address, where the tokens are permanently removed from circulation.

- Exchange-Supported Burns: Binance and other exchanges contribute by burning a portion of their trading fees from LUNC/USTC pairs, which adds to the total burn volume.

- Community-Led Burn Initiatives: The Terra Classic community frequently organizes burn events or votes to increase the burn tax rate, aiming to accelerate the reduction of LUNC supply.

Note: In this context, “community” refers to token holders—individuals who hold UST or LUNA tokens—rather than general enthusiasts or onlookers. This distinction is important for understanding governance and decision-making processes in decentralized ecosystems.

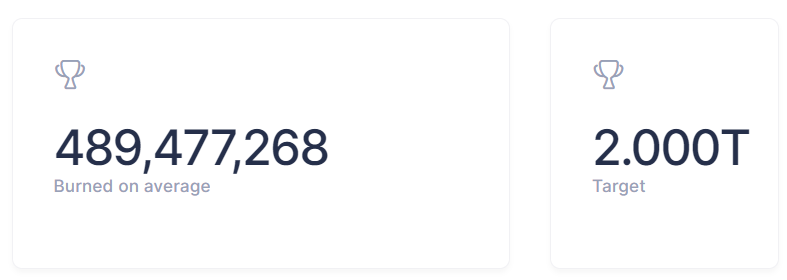

Latest burn and supply metrics for Luna Classic (LUNC)

Credit: https://www.luncmetrics.com/

While the cumulative burn of 388.99 billion is a notable reduction, it represents only a small percentage of the total supply (around 5.98%). With 6.51 trillion LUNC still in circulation, a significant portion remains, and achieving scarcity or substantial price impact will likely require either an accelerated burn rate or increased demand for LUNC.

As of the time of writing, the price of LUNC stands at $0.0000981—a long way from the ambitious $1 target.

The burn strategy for LUNC (Luna Classic) aims to reduce its massive circulating supply, thereby creating scarcity that could, in theory, increase the token’s value over time. This approach is driven by the Terra Classic community, exchanges like Binance, and various tax mechanisms on the Terra Classic blockchain. However, reaching a target price like $1 is a monumental challenge due to the current supply volume and the burn rate’s limitations.

Current Progress and Challenges

Despite burning 388.99 billion LUNC so far, the current circulating supply remains high at 6.51 trillion LUNC. While the weekly burns are steady, averaging hundreds of millions of LUNC, this is only a fraction of the total supply.

Credit: https://www.luncmetrics.com/

At this pace, reducing the supply to a level that would significantly impact the price is a long-term task. With a price of $0.0000981 at the time of writing, even large-scale burns have not yet led to the kind of scarcity that could push LUNC closer to the $1 mark.

Key Challenges to Reaching $1:

- High Supply: With trillions of LUNC still in circulation, the burn rate would need to increase drastically to make a noticeable impact on scarcity.

- Demand vs. Burn Rate: The burn strategy alone may not be enough to drive up the price. For LUNC to appreciate significantly, increased utility and demand would be needed alongside the burns.

- Burn Rate Sustainability: Relying on transaction fees, community initiatives, and exchange support limits the burn rate’s effectiveness, especially as trading volume fluctuates.

Too Little, Too Late

Following one of the most dramatic collapses in crypto history, the Terra Classic community has fought to salvage LUNC’s value through an ambitious burn initiative aimed at reducing its hyperinflated supply. However, with trillions of tokens still in circulation, the task ahead is monumental. Can gradual burns create enough scarcity to impact LUNC’s price, or are they merely a symbolic gesture? As community-driven burns continue and exchanges like Binance join the effort, the Terra Classic ecosystem faces a daunting reality: true recovery may require much more than just reducing supply.

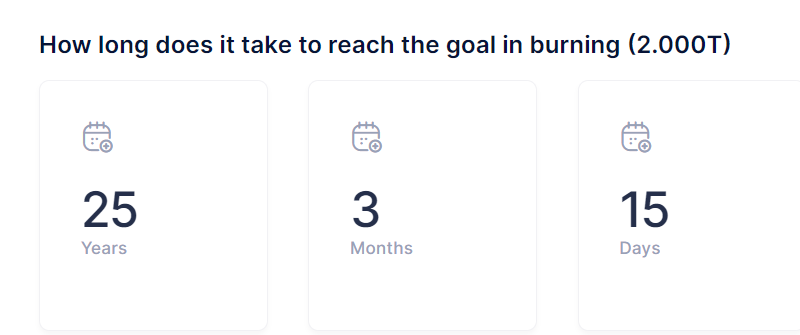

Credit: https://www.luncmetrics.com/

The LUNC burn strategy faces significant challenges that raise doubts about its effectiveness in driving meaningful price recovery. With over 6.51 trillion LUNC in circulation, the current burn rate remains slow relative to the enormous supply, making it difficult to create true scarcity anytime soon. Even if burns increase, the process would still take years to noticeably reduce the total supply, and without strong demand growth, the price effect remains minimal. The Terra Classic community must also contend with “burn fatigue” as sustained burns with limited impact could lead to disillusionment among supporters and investors alike.

Additionally, the strategy is hindered by structural issues, such as dependence on external platforms like Binance for burns, regulatory scrutiny, and stiff competition from newer, more advanced blockchain projects. For LUNC to achieve long-term viability, the Terra Classic ecosystem needs more than just supply reduction; it requires real utility, adoption, and innovation to attract developers and users. Without a broader focus on creating tangible use cases and sustainable demand, the burn strategy may indeed be “too little, too late” to restore significant value to LUNC.

The Road Ahead

While the burn strategy is a meaningful effort by the Terra Classic community to bring value back to LUNC, it faces numerous challenges. The hyperinflated supply, limited burn rate, dependence on trading volume, lack of intrinsic demand, and reliance on community-driven and exchange-supported burns make it difficult for this strategy alone to achieve substantial price gains. For Terra Classic to truly recover, a balanced approach that includes building new utility, fostering ecosystem growth, and attracting sustainable demand will be essential.

Shikha is a DeFi Researcher & Analyst with a background in Engineering, history , political science & International Relations.

Gets her inspiration from a combination of strong tea, beaches and cats. She is passionate about the potential of DeFi and crypto adoption across emerging economies.