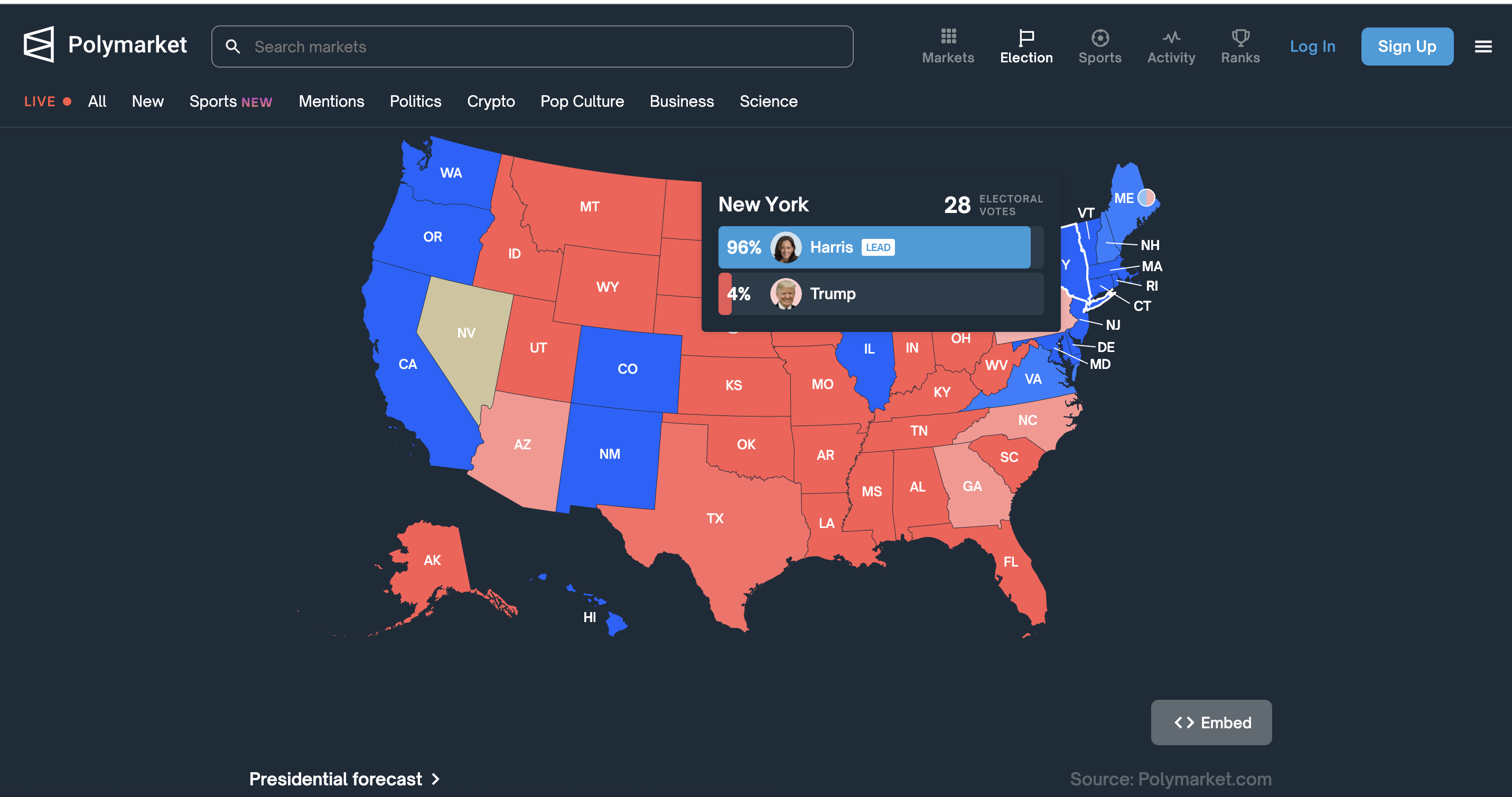

With less than three weeks until the U.S. presidential election, concerns over potential manipulation in decentralized prediction markets are growing. The recent surge in Donald Trump’s odds on Polymarket—a popular blockchain-based prediction platform—has raised red flags about market accuracy.

A key figure behind this trend is a high-stakes bettor known as “Fredi9999,” who reportedly holds more than $20 million in pro-Trump bets. Analysts suggest that this whale’s actions are significantly influencing Trump’s chances on the platform, sparking debates about the reliability and fairness of prediction markets.

Trump’s Odds Surge to Record Levels

On October 16, Polymarket’s data showed Trump’s odds of winning the 2024 presidential election rising to 60.2%, a record high. The sudden increase has puzzled many observers, as it seems disconnected from real-world events that could explain such a shift.

According to Alex Momot, founder and CEO of Peanut Trade, the unusual activity suggests the market itself may be driving public perception, rather than reflecting it:

“The situation on Polymarket is now influencing the real world, where many people believe what they see on the platform. The upcoming U.S. presidential election will serve as a key example for assessing the reliability of prediction markets.”

Is “Fredi9999” Manipulating the Market?

Several experts, including Domer, a pseudonymous political bettor, believe that Fredi9999 may be manipulating Trump’s odds. Domer claims that transaction patterns suggest Fredi might control the top four whale accounts backing Trump on Polymarket.

In a post on X (formerly Twitter) on October 16, Domer revealed:

“The accounts all receive large deposits from Kraken and immediately start betting on Trump everywhere. One account received a million-dollar deposit and drove Trump’s odds of winning the popular vote from 26% to 39% in just a few hours.”

The timing and size of these transactions raise suspicions of strategic attempts to sway the market, with some deposits exceeding $1 million.

When asked about Fredi’s motivations, Domer suggested the bettor may be acting out of confirmation bias:

“My guess is it’s a true believer who is very rich and trying to make a big bet. As the odds increase, his confidence grows, creating a loop where he keeps doubling down.”

The Reliability of Polymarket Under Scrutiny

Polymarket’s growing influence as a prediction tool is now being called into question, as it may be vulnerable to manipulation through multi-accounting and large, strategic bets. Alex Momot emphasized the platform’s exposure to bad actors:

“It’s not surprising that someone is trying to manipulate the platform using financial resources. As high-stakes bets become more common, we’ll see more cases of fake accounts and manipulated outcomes.”

This raises concerns about whether decentralized prediction markets can reliably forecast election outcomes, or if they are susceptible to exploitation by wealthy individuals or groups.

Elon Musk Backs Prediction Markets

Despite concerns about manipulation, Elon Musk has voiced support for decentralized prediction markets, suggesting that they might offer more accurate forecasts than traditional polls. Musk’s recent public endorsements of Trump have added fuel to the speculation around prediction markets’ role in shaping political narratives.

Trump’s Odds Rise Across Multiple Betting Platforms

Trump’s odds of winning the election are not just climbing on Polymarket. The trend extends across several betting platforms, although to a lesser degree. As of October 18 at 11:19 AM UTC, Trump’s odds stood at:

- Polymarket: 60.7%

- Betfair: 58.8%

- Kalshi: 57%

- PredictIt: 56%

- Smarkets: 58%

The general betting average compiled by RealClearPolling shows Trump’s overall odds at 58.1%, compared to Kamala Harris—who holds odds of 40.4%.

Conclusion

The surge in Trump’s Polymarket odds has raised critical questions about the reliability of decentralized prediction markets, especially as wealthy participants appear to have the power to influence outcomes. With Election Day drawing near, the role of platforms like Polymarket in shaping public perception will come under greater scrutiny. As more investors use these markets as indicators of real-world trends, ensuring fairness and transparency becomes increasingly important.

Whether Polymarket’s data proves accurate or manipulated will provide key insights into the future role of blockchain-based prediction platforms in major events like national elections.

FAQs

1. What is Polymarket?

Polymarket is a decentralized prediction market where users can bet on the outcome of real-world events, such as elections, using cryptocurrency.

2. Why are there concerns about manipulation on Polymarket?

Large bettors like Fredi9999 are placing millions in strategic bets, influencing Trump’s odds without any clear real-world events to justify the changes.

3. What is a prediction market?

A prediction market allows participants to bet on the outcome of events, with prices reflecting the likelihood of those outcomes. They are often used as forecasting tools for politics, sports, and more.

A.k.a – alpha girl. Vinita is the founder of Alphachaincrypto. An English Lit Majors, Vinita bumped into Web3 in 2020 only to realise that tech was her calling. Later, Mathreja worked for some notable brands like Near Education, Biconomy, CoinDCX and top of the line crypto start ups.