The CEO of Microstrategy – Michael Saylor is one of the finest Bitcoin Maximalists till date.In 2020, Microstrategy bought its first Bitcoin tokens—spending $250 million to buy 21,454 at an average price of about $12,000 each. Saylor was a crypto skeptic before he discovered Bitcoin.

Imperfect assets, imperfect systems – how is Bitcoin going to help fight inflation?

In his talk at Bitcoin Conference held in Nashville, Saylor took a never before heard theory by Tesla “you want understand the universe think in terms of energy frequency and vibration “

Energy = Capital

Frequency = For how long you stay invested

Vibration = The transactions – it can be a trade, a swap or transfer.

All three are connected. The important equation is if you’re looking for the useful life of your money in an asset then the way to figure it out is to ask how much does it cost every year to maintain that asset in pristine condition. What do I have to spend in order to avoid depreciation or decay?

He noted that traditional assets, whether financial or physical, suffer from various forms of “entropy,” such as inflation, taxes, and maintenance costs, which erode their value. In contrast, Bitcoin, as a form of digital capital, offers a solution to these issues due to its immutability, scarcity, and independence from physical decay.

He explained that Bitcoin’s intrinsic properties, such as a fixed supply and decentralized nature, make it a superior asset for long-term capital preservation. Saylor likened Bitcoin to “cyber Manhattan,” suggesting that it represents a new, digital form of prime real estate where capital will increasingly flow.

The Case for Bitcoin

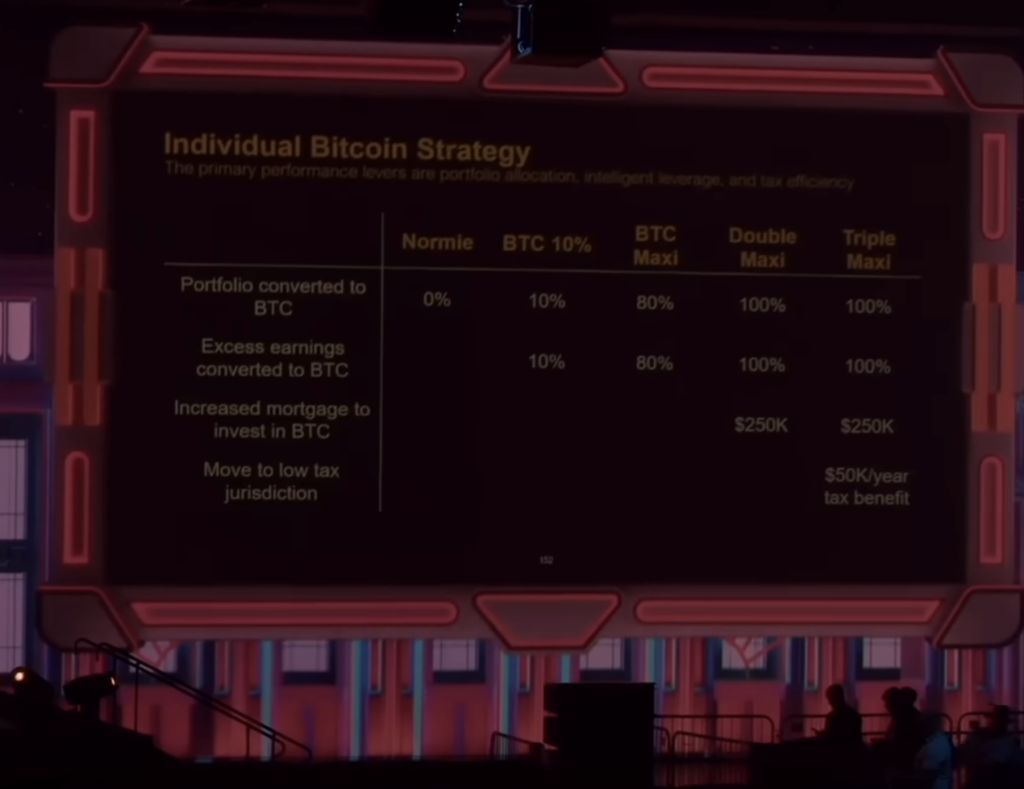

Saylor provided a compelling case for why individuals, corporations, and even nations should adopt Bitcoin as a primary asset. He outlined several strategies for different levels of investment commitment, ranging from conservative allocations to aggressive, leveraged positions. For individuals, he emphasized the importance of converting excess earnings into Bitcoin and avoiding risky leverage. For corporations, he recommended making Bitcoin the primary treasury asset and utilizing favorable tax and debt strategies to maximize returns.

He also discussed the implications for national economies, suggesting that countries would benefit significantly by reallocating their reserves from traditional assets like gold and bonds to Bitcoin.

He argued that Bitcoin could serve as a hedge against inflation and a tool for strengthening national security by providing a resilient and untouchable store of value.

The Future of Bitcoin

In his closing remarks, Saylor presented a long-term outlook for Bitcoin, predicting that its adoption and value would continue to grow significantly. He projected a potential price of $13 million per Bitcoin by 2045, assuming a steady adoption rate and increasing market penetration. He emphasized that this growth would not only benefit early adopters but could also drive a broader economic transformation.

Wrapping Up

His presentation at the Bitcoin conference stands out as a clarion call for individuals, corporations, and nations to reconsider their approach to capital preservation and embrace the digital revolution. Saylor also slated a fundamental that should be applied when regulating Bitcoin.

Promote self custody for Bitcoin for individuals and corporations and support integration with the banking system of your country.

The future of money, as Saylor envisions it, is digital, decentralized, and driven by Bitcoin.

Source: Bitcoin Magazine Youtube Channel.

A.k.a – alpha girl. Vinita is the founder of Alphachaincrypto. An English Lit Majors, Vinita bumped into Web3 in 2020 only to realise that tech was her calling. Later, Mathreja worked for some notable brands like Near Education, Biconomy, CoinDCX and top of the line crypto start ups.