Bitcoin has been experiencing some volatility as it hovers around the $98,000 mark heading into Christmas Day. The cryptocurrency saw a Santa rally with $4,000 daily gains, but price action has cooled off as the holiday period begins.

Currently, Bitcoin is trading between two key trend lines – the 21-day and 50-day simple moving averages (SMAs). These SMAs sit at approximately $99,600 and $94,650 respectively. Prior to dipping below it recently, Bitcoin had been using the 21-day SMA as support since mid-October.

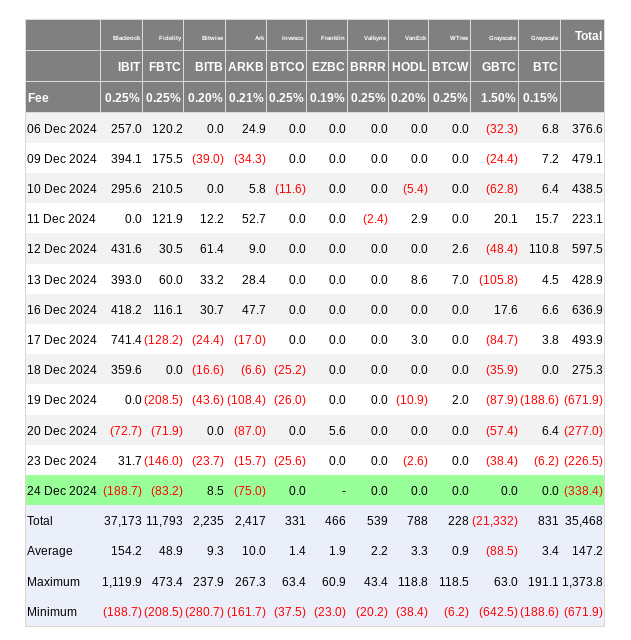

Some analysts remain optimistic about Bitcoin’s near-term prospects. Trader Skew noted a bullish relative strength index (RSI) divergence on the 4-hour chart, describing recent downward price action as a “failed auction”. However, sustained outflows from US spot Bitcoin ETFs cast a shadow over the rebound, with $1.5 billion in net outflows over just four days.

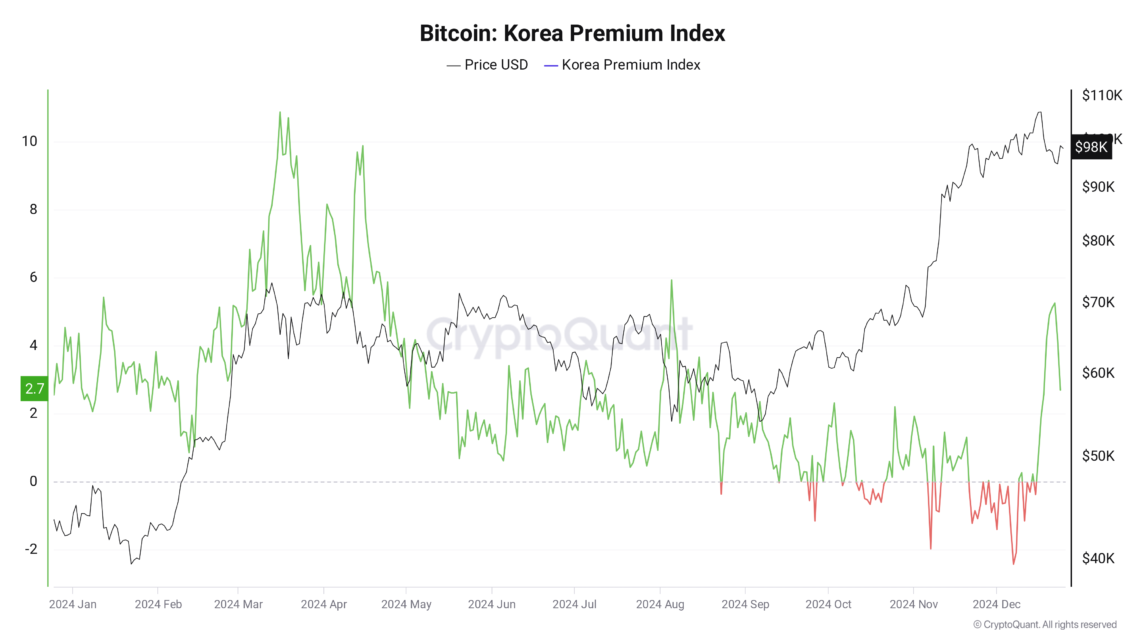

Interestingly, demand appears to be increasing in South Korea. The “Kimchi Premium” – the price difference between South Korean exchanges and others – has surged to a local high of 5.12%, indicating strong buying interest from South Korean investors. This aligns with data showing a 3 percentage point increase in short-term holders over the past week.

The Bitcoin market cap currently stands at around $3.26 trillion. While some analysts predict Bitcoin could reach $180,000 – $200,000 in 2025, near-term price action remains uncertain. Factors like potential US adoption of a Bitcoin strategic reserve and continued ETF inflows could drive prices higher, but Federal Reserve policy and market volatility may pose challenges.

As traditional markets close for the holidays, Bitcoin may see a reprieve from recent selling pressure2. However, with thin holiday trading volumes, the cryptocurrency market remains susceptible to increased volatility in the short term.

A.k.a – alpha girl. Vinita is the founder of Alphachaincrypto. An English Lit Majors, Vinita bumped into Web3 in 2020 only to realise that tech was her calling. Later, Mathreja worked for some notable brands like Near Education, Biconomy, CoinDCX and top of the line crypto start ups.