ANZ Bank Among the First to Pilot Chainlink’s New Privacy Tech for Tokenized Asset Settlement in Singapore’s Project Guardian

Chainlink, a decentralized oracle network built on Ethereum, has introduced cutting-edge technology designed to help financial institutions maintain data privacy when conducting transactions on blockchain networks.

On October 22, the company launched two new privacy-focused solutions aimed at institutions seeking to leverage blockchain applications while ensuring complete confidentiality throughout the transaction process.

New Privacy-Preserving Solutions by Chainlink

The latest developments from Chainlink include:

- Blockchain Privacy Manager – A tool that facilitates the integration of private blockchains with Chainlink’s public platform.

- CCIP Private Transactions – An encryption protocol that ensures sensitive data remains protected across multiple blockchain environments.

ANZ Bank to Test Blockchain Privacy Tech for Real-World Asset Settlement

The Australia and New Zealand Banking Group (ANZ Bank) will be one of the first institutions to adopt Chainlink’s privacy-preserving technology. As part of Singapore’s Project Guardian, ANZ will utilize Chainlink’s tools for cross-chain settlement of tokenized real-world assets (RWAs).

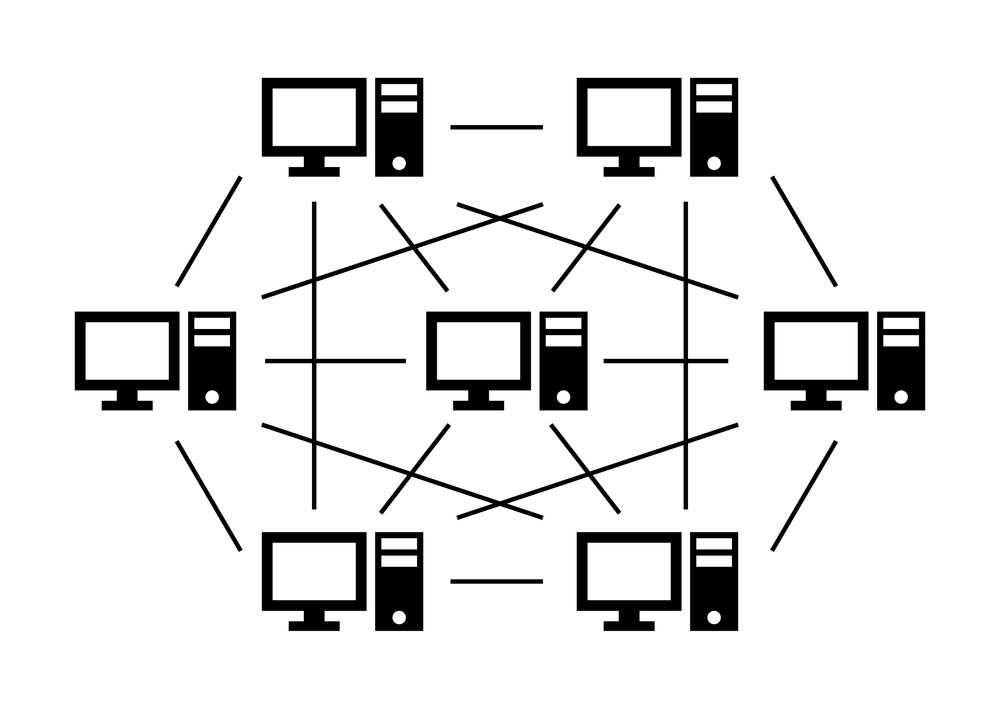

Using the Blockchain Privacy Manager, ANZ and other institutions can seamlessly connect private blockchains with other public or private networks via the Chainlink Cross-Chain Interoperability Protocol (CCIP). Additionally, the system supports linking traditional financial and enterprise systems with blockchain networks, enhancing interoperability and privacy.

The CCIP Private Transactions protocol allows encryption of key data elements such as token amounts and transaction counterparties. Only authorized participants can decrypt this information, maintaining confidentiality even across multiple blockchain environments.

Key Benefits of Chainlink’s Privacy Solutions

These new privacy features enable financial institutions to define privacy rules that ensure transaction data remains confidential, even from third parties or malicious actors. Authorized users, including regulators or compliance officers, can still access this data as needed to meet legal and regulatory requirements.

Why Financial Institutions Need Blockchain Privacy

Many financial institutions have hesitated to adopt blockchain technology due to concerns around data privacy. Without secure mechanisms for cross-chain privacy, meeting stringent data protection regulations—such as Europe’s General Data Protection Regulation (GDPR)—is challenging.

Chainlink’s solution addresses these concerns by providing end-to-end encryption for private-to-private blockchain transactions, as well as controlled data exposure for private-to-public interactions.

Sergey Nazarov on the Future of Blockchain in Finance

Sergey Nazarov, co-founder of Chainlink, emphasized the importance of privacy in institutional transactions:

“Privacy is a critical requirement for most institutional transactions,” Nazarov stated. “We expect significant growth in blockchain adoption among institutions, now that cross-chain private transactions are achievable.”

He further noted that Chainlink’s partnership with ANZ Bank will explore new ways to process large-scale transactions across multiple blockchains while meeting compliance and regulatory requirements.

Conclusion

With the launch of its Blockchain Privacy Manager and CCIP Private Transactions, Chainlink is addressing a major pain point in blockchain adoption for financial institutions. As ANZ Bank begins piloting these technologies under Singapore’s Project Guardian, other institutions are likely to follow suit, paving the way for broader blockchain adoption in the finance sector.