In a world driven by data and probability, prediction markets are becoming increasingly popular. One of the notable players in this space is Polymarket, a decentralized platform that allows users to speculate on the outcome of various events. But what exactly is Polymarket, and how does it work? This article delves into the fundamentals of Polymarket, its features, how it functions, and why it’s gaining attention in the decentralized finance (DeFi) and blockchain space.

Understanding Prediction Markets

Before diving into Polymarket, it’s essential to understand what prediction markets are. Prediction markets are platforms where participants can trade shares representing the likelihood of future events. These markets leverage the collective intelligence of participants, allowing the prices of these shares to reflect the consensus probability of an event occurring. Essentially, prediction markets aggregate information and predict outcomes more accurately than individual experts or opinion polls.

Prediction markets are used in various domains, from forecasting election results and sports outcomes to predicting business trends or societal shifts. The insights gained from these markets are valuable as they often provide more accurate predictions compared to traditional methods.

What is Polymarket?

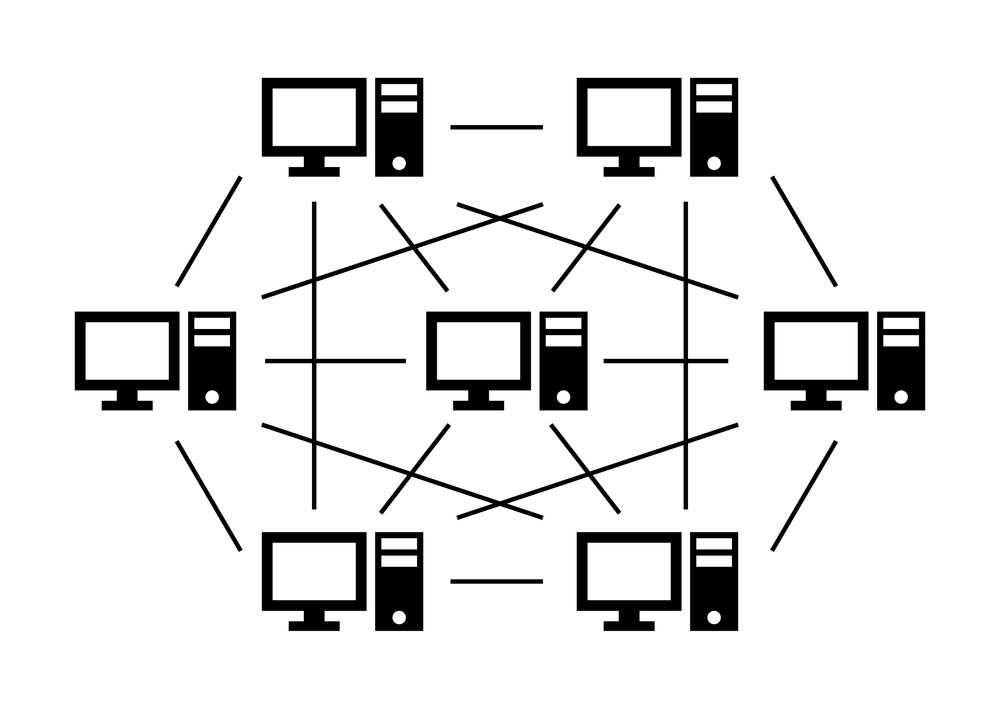

Polymarket is a decentralized prediction market built on the Ethereum blockchain. It allows users to trade on the outcomes of real-world events using cryptocurrency, such as USD Coin (USDC). The platform focuses on providing a transparent, trustless, and user-driven marketplace where participants can speculate on diverse topics, ranging from politics and entertainment to financial trends and global news.

Launched in 2020, Polymarket distinguishes itself by offering a user-friendly interface and a unique mechanism for trading outcome shares. It has quickly become a popular choice for users looking to engage in prediction markets, thanks to its low fees, robust security, and commitment to decentralization.

How Polymarket Works

Polymarket operates by enabling users to buy and sell shares based on their beliefs about the likelihood of specific events occurring. Here’s a step-by-step breakdown of how Polymarket functions:

- Event Creation and Market Setup: Users can create markets for events they are interested in or participate in existing markets. Each market has a set of outcomes, such as “Yes” or “No,” representing the potential scenarios of an event.

- Liquidity Pools and Trading: Polymarket uses an Automated Market Maker (AMM) model, where liquidity pools determine the price of shares based on the demand for each outcome. When users buy shares, they are essentially betting on a particular outcome, and the price adjusts accordingly.

- Trading Outcome Shares: Each outcome in a Polymarket event is represented by a share that users can trade. The price of each share fluctuates based on the buying and selling activity within the market. For instance, if many people buy shares for a “Yes” outcome, the price of “Yes” shares will increase, indicating a higher probability of that outcome occurring.

- Resolution and Payout: Once the event concludes, the market is resolved based on verified outcomes. Users who hold shares in the winning outcome receive a payout proportionate to their holdings, while those holding shares in losing outcomes get nothing.

Why Polymarket Stands Out

Polymarket’s unique features make it stand out in the prediction market landscape. Some of its key advantages include:

- Decentralization: Built on the Ethereum blockchain, Polymarket ensures that no central authority can manipulate market outcomes or restrict trading. This decentralization fosters transparency and trust among users.

- Low Fees and Fast Settlements: Thanks to its integration with layer-2 scaling solutions like Polygon, Polymarket offers low transaction fees and fast settlement times, making it accessible to a broader audience.

- Diverse Market Topics: Polymarket covers a wide range of topics, allowing users to speculate on global events, politics, sports, finance, and much more. This diversity attracts a varied user base and fosters more accurate predictions due to the collective knowledge of participants.

- Access to Reliable Information: The platform aggregates information from multiple sources and users’ collective intelligence, making its predictions more reliable. As a result, Polymarket has become a valuable tool for researchers, investors, and individuals interested in understanding public sentiment on various issues.

Potential Use Cases of Polymarket

Polymarket’s application goes beyond speculation. It can be a valuable resource in multiple domains:

- Political Forecasting: Polymarket’s prediction markets on election outcomes or policy decisions offer insights into political trends and public sentiment. The accuracy of these predictions can often surpass traditional polls.

- Financial Market Predictions: Traders and investors use Polymarket to predict economic indicators, such as interest rate changes, stock market movements, or commodity prices. These markets provide a unique perspective on financial trends.

- Research and Data Analysis: Analysts and researchers leverage Polymarket to study crowd behavior and information aggregation in decentralized settings. The data derived from prediction markets can be used to improve decision-making processes in various fields.

The Future of Polymarket and Prediction Markets

Polymarket’s growth is a testament to the increasing interest in decentralized finance and prediction markets. As blockchain technology evolves and regulatory frameworks become clearer, Polymarket has the potential to become a mainstream platform for speculation and information aggregation.

The platform’s emphasis on transparency, user-driven markets, and data accuracy positions it as a key player in the prediction market space. Furthermore, the ongoing development of blockchain and DeFi technologies will likely lead to even more innovative features and use cases for Polymarket and similar platforms.

Conclusion

Polymarket is revolutionizing the way people engage with prediction markets. Its decentralized structure, diverse market topics, and user-friendly interface make it an attractive platform for anyone looking to speculate on future events. Despite regulatory and liquidity challenges, Polymarket’s potential to provide valuable insights and accurate predictions remains significant. As more users and developers join the platform, Polymarket is set to shape the future of prediction markets and decentralized finance.