Leveraged Bitcoin Exchange -Traded Funds (ETFs) have gained popularity among investors seeking amplified exposure to Bitcoin’s price movements. However, this approach comes with significant risks and potential drawbacks. Here, we explore why investors might want to reconsider their strategies and look at alternative investment avenues.

Understanding Leveraged Bitcoin ETFs

Leveraged Bitcoin ETFs are designed to provide multiple times the daily return of the underlying asset, Bitcoin. This means if Bitcoin’s price increases by 1%, a 2x leveraged ETF would ideally increase by 2%. Conversely, if Bitcoin’s price drops, the losses are also magnified.

These funds are intended for short-term trading rather than long-term investment due to their daily rebalancing nature, which can lead to substantial losses if held over longer periods.

Risks of Leveraged Bitcoin ETFs

1. High Volatility: Leveraged ETFs amplify the inherent volatility of Bitcoin. While this can lead to significant gains, it also exposes investors to greater potential losses. Market downturns can severely impact the value of these investments, making them highly unpredictable and risky.

2. Compounding Effects: The daily resetting feature of leveraged ETFs causes a compounding effect, which can erode returns over time. Even if Bitcoin ends up where it started after a period, the ETF might not reflect the same result due to daily fluctuations and resets.

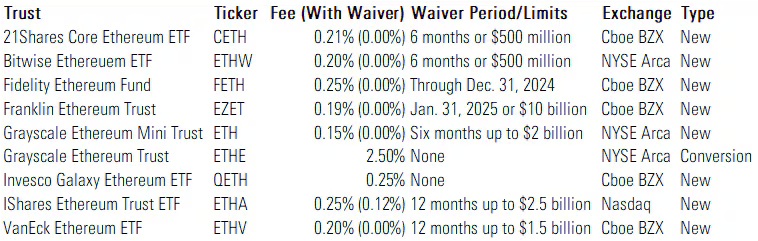

3. Cost and Fees: ETF operating expenses are commonly expressed through the fund’s Operating Expense Ratio (OER).

Source: Issuer Form S-1s. Securities and Exchange Commission EDGAR Online. Securities and Exchange Commission, 21 July 2024, www.sec.gov/edgar.shtml. Note: Information is subject to change.

Alternatives to Leveraged Bitcoin ETFs

Given the risks associated with leveraged Bitcoin ETFs, investors might consider other strategies that offer exposure to the cryptocurrency market with potentially lower risk and more stable returns.

1. Spot Bitcoin ETFs: Unlike leveraged ETFs, spot Bitcoin ETFs track the actual price of Bitcoin without leveraging. This makes them a less risky option for those who want to invest in Bitcoin over the long term. These funds provide direct exposure to Bitcoin’s price movements without the daily rebalancing that leads to compounding issues.

2. Diversified Cryptocurrency Funds: Investing in diversified cryptocurrency funds can spread risk across multiple assets rather than focusing solely on Bitcoin. These funds include a variety of cryptocurrencies, which can help mitigate the volatility associated with investing in a single asset.

3. Traditional ETFs with Blockchain Exposure: Investors can also consider ETFs that invest in companies involved in blockchain technology and cryptocurrency operations. These funds offer exposure to the growth of the crypto industry without directly investing in cryptocurrencies themselves.

4. Individual Bitcoin Investment: Purchasing Bitcoin directly and holding it in a secure wallet allows investors to have full control over their investment. This approach eliminates the risks associated with leveraged products and avoids additional fees and compounding issues.

5. Invest in firms linked to cryptocurrencies: There are some really valuable crypto linked stocks. Microstrategy, Blackrock, NVIDIA to name a few.

Making Informed Investment Decisions

When considering investment in the cryptocurrency market, it’s crucial to assess your risk tolerance and investment goals. Leveraged Bitcoin ETFs may offer high rewards, but they come with substantial risks that might not align with every investor’s strategy. Exploring alternatives like spot ETFs, diversified funds, and direct Bitcoin investment can provide more stable and manageable options for those looking to benefit from the cryptocurrency market.

By understanding the complexities and risks associated with leveraged Bitcoin ETFs, investors can make more informed decisions and consider alternative strategies that better align with their financial goals and risk tolerance.

A.k.a – alpha girl. Vinita is the founder of Alphachaincrypto. An English Lit Majors, Vinita bumped into Web3 in 2020 only to realise that tech was her calling. Later, Mathreja worked for some notable brands like Near Education, Biconomy, CoinDCX and top of the line crypto start ups.